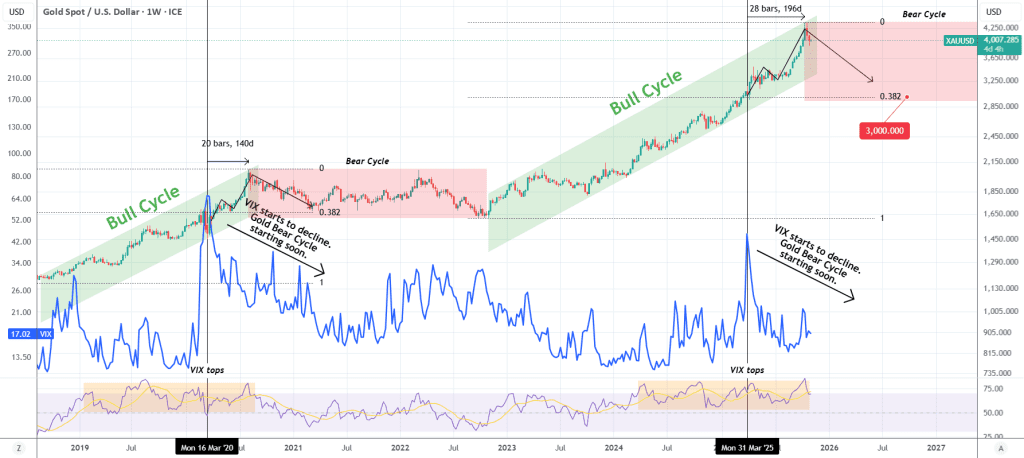

چرخه نزولی XAUUSD شروع شده و دلیلش از نظر VIX اینه.

Gold (XAUUSD) closed 2 straight red weeks, which last did on June 23. Despite

this pull-back, it remains within a Channel Up since the October 31 2022 Low,

which was essentially when the Bear Cycle ended and the new Bull Cycle (Channel

Up) started.

The previous Bull Cycle topped around 4.5 months after the Volatility Index

(VIX) shown in blue, peaked during the March 2020 COVID flash crash.

We are now on a similar situation as VIX topped on the week of March 31 2025

during the Trade War and has since started to decline aggressively. Gold’s

current top was 6.5 months after VIX’s top. Even the 1W RSI sequences between

the two Bull Cycles are similar, further raising the degree of their high

symmetry.

According to this correlation, Gold may has already formed its Bull Cycle Top 3

weeks ago and could be starting a new +2 year Bear Cycle.

As far as a Target and Bottom is concerned, the previous Bear Cycle almost hit

its 0.382 Fibonacci retracement level three times throughout the Cycle, until it

broke below it marginally for its September – October 2022 bottom.

As a result, we are looking for the 0.382 Fib yet again as our focal point which

is currently around $3000.

——————————————————————————-

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also

share your ideas and charts in the comments section below! This is best way to

keep it relevant, support us, keep the content here free and allow the idea to

reach as many people as possible. **

——————————————————————————-

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

منبع: تریدینگ ویو